Achieving financial stability requires proper planning and a sound investment strategy. Here, FD can offer a secure investment option where one can forecast returns accurately, which helps a lot in planning and investing for the short- and long-term goals. This privilege isn’t possible with market-linked instruments as volatility affects their returns. Bajaj Finance offers a specialised tool known as the Fixed Deposit Interest Calculator, making it easier for investors to plan their investments. Calculating the fixed deposit interest returns becomes simple, convenient, and error-free with the Bajaj Finance FD calculator.

To know the different ways to calculate fixed deposit interest earnings and how to use a digital calculator, read on.

Steps to calculate interest returns with the FD interest calculator

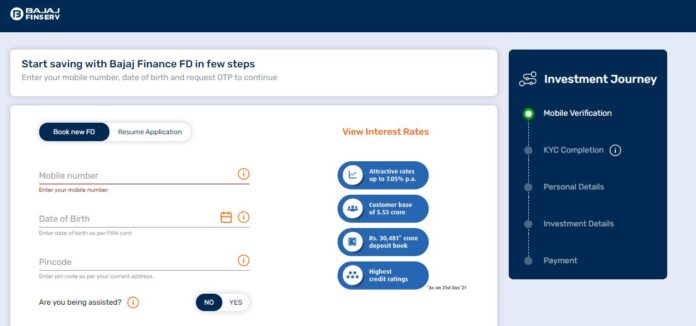

Using the Bajaj Finance Fixed Deposit interest calculator is simple and easy. All one needs to do is follow these simple steps:

Step 1: Log on to the official calculator webpage

Step 2: Select the investor type – senior citizen or customer below the age of 60

Step 3: Enter the accurate values for the investment amount and tenor

Step 4: Choose the payout mode and view the results displayed

In just four simple steps, investors can calculate their earnings and get accurate results within seconds. Additionally, investors can also choose the frequency of payouts and get the applicable interest earnings. All one needs to do is click on the ‘Compare Interest Payouts’ option and view the section that displays the different payout amounts based on the payout mode. It allows investors to do a thorough comparative analysis of their options.

Steps to calculate fixed deposit interest manually

The fixed deposit interest rates are compounded periodically by all FD issuers. In most cases, this is done annually, but investors must know the frequency when looking to calculate the interest earnings accurately. To go ahead with the manual calculation, one will need to know the principal amount, tenor, compounding frequency, and fixed deposit interest rate.

Note that calculating interest earnings manually is time-consuming and prone to errors. A fixed deposit interest calculator simplifies this task, making it quicker and easier while offering reliable results.

Benefits of the fixed deposit interest calculator

Using the Bajaj Finance Fixed Deposit calculator offers investors several benefits, which include:

Accurate results

Calculating the interest through the manual formula is prone to human error. This online calculator automatically processes the inputs and gives accurate results.

Time-efficient

Manual calculations may take time as one is required to convert values and follow the formula accurately. On the other hand, the is quick and provides speedy results.

Reliable information

The Bajaj Finance Fixed Deposit calculator helps in financial planning as the information displayed is always accurate. It is key to making the right decisions based on the objectives. The interest rates vary according to the investment tenor selected. A longer tenor fetches a higher interest rate.

Aids in comparative analysis

Investors can choose to either opt for cumulative or non-cumulative fixed deposits. Bajaj Finance offers this feature, but the interest rate varies based on the payout mode opted for by investors. For a non-cumulative fixed deposit, interest payouts are made monthly, half-yearly, or annually. The FD calculator accurately showcases the interest payouts for these modes, allowing investors to make the right decisions.

For instance, senior citizen investors looking to set up a stream of income through interest earnings can use the FD calculator to know exactly how much they can expect to get. Similarly, individuals who require additional liquidity throughout the tenor can also quickly see the interest they can expect.

Investing in fixed deposits and calculating the fixed deposit interest returns has become much easier with digital tools. Investors can now invest online in a Bajaj Finance Fixed Deposit and access all the offered features. Investors can get profitable earnings generously depending on their investor profile and the tenor. What’s more, Bajaj Finance offers a flexible FD tenor ranging from 12 to 60 months. It helps investors build a sizable corpus, no matter the tenor they choose.