Global E-Cigarette Market by Category (Tobacco Flavored E-Liquids, Botanicals, Fruit Flavors, Nicotine Free E-Liquids); By purchase channel (Online, Specialist Vape/E-Cigarette Stores, Other Physical Retailers), By type (Modular, Disposable, Rechargeable) – Outlook to 2021 provides a comprehensive analysis of e-cigarette market across the world. The report includes the market size by revenue, segmentation for different regions (Asia Pacific, Americas, Middle East and Africa and Europe) by revenue, Segmentation for major countries in region by revenue, segmentation by type of e-cigarette (Tobacco, Botanical, Nicotine and Fruits), segmentation by sales channel, nicotine strength and product type. The report also covers global industry trends, developments, challenges and restraints. The report clearly highlights the major reasons for preference of e-cigarette across different geographies. The report also highlights the company profile of major e-cigarette companies including the product launch, recent developments, business strategies, product portfolio and others. The report also covers the detailed country profile of the US, the UK, Russia, Poland and other European nations for e-cigarette market. The report concludes with future projections of overall global e-cigarette market and analyst recommendations.

Global E-Cigarette Market

Global E-Cigarette Market Size

The market size of e-cigarettes in 2011 was USD ~ million and it grew to USD ~ million in 2016. The global e-cigarette registered a CAGR of ~% from 2011-2016. Various mergers and acquisitions took place between e-cigarette companies during the review period. Many big e-cigarette companies acquired small local players to gain more market share and enter into the local markets. Various mergers and acquisitions that took place in the e-cigarette market around the globe are BAT and CN Creative, Lorillard and Blu, Imperial and Blu, Japan Tobacco and Logic and others.

Global E-Cigarette Market Segmentation

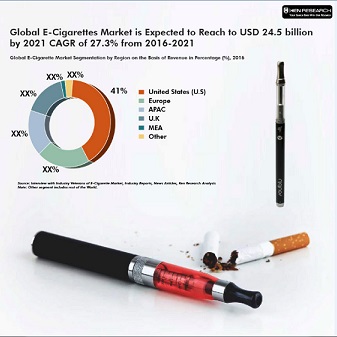

Segmentation by Region: The market of e-cigarettes has been segmented on the basis of regions. The regions that have been included in the report are US, UK, Europe, APAC and MEA. The US market dominated the global e-cigarette market contributing ~% of the total e-cigarette market revenue during 2016. The next region that dominated the e-cigarette market was Europe, with ~% of the total market share during 2016. France contributed the largest revenue in the region with ~% of the overall revenue of Europe followed by Italy and Poland. Asia-Pacific contributed ~% to the overall global e-cigarette market revenues during 2016. Despite a large number of people engaged in the smoking in this region, the people adopting vaping are very limited and the e-cigarette market in APAC region is at a nascent stage.

By Types of Flavors of E-Liquids and E-Cigarettes: The most dominated flavor in the global e-cigarette market is tobacco which contributed around ~% of the global e-cigarette revenue in 2016 followed by botanicals with ~% of the revenue, fruit flavored products with ~% of the revenue and nicotine flavored e-liquids with ~% contribution in the global e-cigarette market during the same year. In most countries of the world, people start using e-cigarettes with the tobacco flavor as they want to mimic the art of smoking, taste and feel of smoking.

By Purchase Channel: The various channels available for the purchase of e-cigarettes are online channels, vape stores and other retail stores. Online channel contributed ~% of the revenue generated by the overall sales of e-cigarettes in the world. In most of the countries, online channel for the distribution and sales of e-cigarettes is more prevalent. This is because it provides ease of buying products and also people can compare the prices of the same product from various websites thus helping them to buy the same product at a lower cost. The vape shops contributed ~% of the revenue generated by the global e-cigarette market.

By Product Type: The e-cigarette devices can be broadly classified into modular, rechargeable and disposable e-cigarettes. The modular e-cigarettes generated around ~% of the revenue in the global e-cigarette market. The rechargeable e-cigarettes generated revenue of ~% in the global e-cigarette market. The prices of the rechargeable e-cigarettes are comparatively higher than the disposable e-cigarettes. However, it is slightly lower than modular e-cigarettes. The disposable e-cigarettes contributed ~% of the total revenue generated by the sales of all e-cigarettes in the world.

By Nicotine Strength: The nicotine strength have been divided into four categories zero nicotine, 1-6mg, 7-15mg and more than 15mg. The zero nicotine strength e-liquids contributed ~% of the overall revenue earned by selling the e-cigarette products globally. The nicotine strength of 1-6mg contributed ~% in the global e-cigarette market whereas 7-15mg nicotine strength contributed ~% of the overall e-cigarette market of the world.

Competitive Landscape of Major Players

The global e-cigarette market is highly fragmented. There are more than 500 e-cigarette players operating and selling e-cigarettes under different brand names around the world. With larger players entering the market, the smaller players such as Ballantyne Brands, FIN Branding and many other small Chinese manufacturers are facing huge competition in the global e-cigarette market. The major companies that dominated the global e-cigarette market are VMR, RJ Reynolds, British American Tobacco, Njoy, Altria, International Vapor Group, Japan Tobacco and many more. These companies contributed around ~% of the total e-cigarette market of the world. The players in the e-cigarette market compete on the basis of different products and flavours of e-liquids that the companies sell.

Future of Global E-Cigarette Market

The market size of e-cigarettes globally in terms of revenue was USD ~ million in 2016 and is estimated to grow at a CAGR ~% from 2016-2021. The market size is estimated to increase to USD ~ million by 2021. The governments across various countries have been implementing stringent policies relating to the tobacco and smoke industry. This will increase the potential of the e-cigarette market. The companies around the world have been competing against each other by introducing more flavours in the market.

Snapshot on US E-Cigarette Market

The e-cigarettes were introduced in the United States during 2006-2007. The scientists and health officials linked cigarette smoking to a large number of adverse effects on health and it was considered to be a major reason for premature death in the United States. In terms of market revenue, the market recorded an increase from USD ~ billion in 2011 to USD ~ billion in 2016 at a significant CAGR of ~% during the same period.

By type of devices, Tank and vapor system dominated the US e-cigarette market by accounting for ~% and ~% respectively to overall e-cigarette market revenues during 2016. By sales channel around ~% of the revenue is earned by retail stores which include vape shops and convenient stores followed by ~% through online channel and ~% by other retail stores such as grocery stores, supermarkets and gas stations during 2016.

The companies such as Altria, Reynolds American, White Cloud, Hana Modz and many others have not just started producing e-cigarettes but are also selling the e-cigarettes in the international markets which have increased the exports of the country. The major e-cigarette players in the country include Reynolds American, Fontem, Altria, Logic and Njoy.

Snapshot on UK E-Cigarette Market

The electronic cigarettes were introduced in UK market in the year 2006. The number of vape stores in UK has increased from ~ in 2015 to ~ stores in 2016. In UK, e-cigarette market is one of the fastest growing products both by volume and value. In 2011, the total number of e-cigarette users was 1.5 million and the number grew to ~ million in 2016. The market for e-cigarettes in 2011 was USD ~ million and it stood at USD ~ million in 2016. The local manufacturers present in the UK market are Apollo, ROK Universal, E-Lites and Blu (Imperial Brands).

Key Topics Covered in the Report

Executive Summary

Research Methodology

Global E-Cigarettes Product Evolution

Value Chain Analysis of Global E-Cigarettes Market

Global E-Cigarettes Market Size by Revenue, 2011-2016

Global E-Cigarettes Market Segmentation, 2011-2016

Consumer Profile of Global E-Cigarette Market

Decision Making Process Before Buying E-Cigarettes

Trends and Developments in Global E-Cigarette Market

Government Rules and Regulations in E-Cigarette Market

Competitive Landscape of Major Players

Future of Global E-Cigarette Market

Snapshot on The United States E-Cigarette Market

Snapshot on The UK E-Cigarette Market

Snapshot on Russia E-Cigarette Market

Snapshot on E-Cigarette Market in Poland

Snapshot on E-Cigarette Market in Germany

Snapshot on E-Cigarette Market in China

Snapshot on Italy E-Cigarette Market

Snapshot on France E-Cigarette Market

Snapshot on Malaysia E-Cigarette Market

Snapshot on South Korea E-Cigarette Market

Analyst Recommendations

Source: https://www.kenresearch.com/food-beverage-and-tobacco/tobacco-products/global-e-cigarrette-market/142271-11.html