Currently, 1 out of 4 online customers drop off from the product page owing to high upfront costs

Affordability Widget aims to significantly boost the revenue of businesses by increasing customer conversions

Driven by its customer-first approach, Razorpay, India’s Leading Full-Stack Payments and Banking Platform for Businesses, today announced the launch of an industry-first solution, the Affordability Widget. Currently, 1 out of 4 customers shopping online drop off before the checkout page because of high upfront costs and lack of discoverability of affordable payment and credit options and offers. To address this issue faced by millions of businesses, the Affordability Widget aims to solve for high customer drop-offs by showing affordable payment options on the product page itself, thereby making high-value orders a lot more affordable for customers and thereby helping increase revenue for businesses.

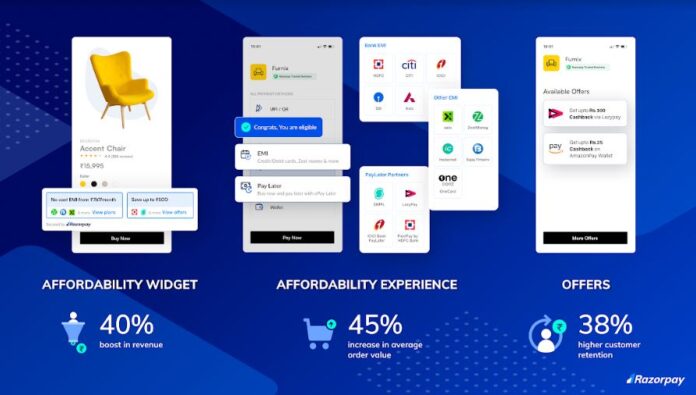

Affordability Widget featuring different affordable payment options (No Cost EMIs, Paylater, Offers) before checkout

Customers are increasingly preferring to pay through EMIs, Cardless EMIs & PayLater options while buying high-value consumer items, as affordability has become a key factor in the post-pandemic scenario. As per industry reports, 70% of shoppers between 25-44 years prefer Buy Now Pay Later (BNPL) payment options when shopping online.

The Affordability Widget is compatible with all eCommerce websites and platforms such as Shopify and Woocommerce and involves no manual intervention. It makes access to credit easy by aggregating relevant payment options like EMI, Pay Later and Offers and helps consumers shop and pay later even without access to a credit card. With the Affordability Widget, businesses stand to gain over 45% increase in average transaction value as it encourages more purchases with higher spending power.

Khilan Haria, SVP, and Head of Payments Product, Razorpay

Commenting on the launch, Khilan Haria, SVP, and Head of Payments Product, Razorpay said, “Given that only 5% of individuals have access to credit cards in India, there is a very substantial need to empower customers with more flexible and affordable payment options so they can buy what they need when they want. While affordable payment options already exist, cart abandonment problem still persists causing businesses to lose over 30% in sales revenue annually, we want to solve that and help end-consumers discover payment options early on in their shopping journey and help aid in decision-making. And the launch of the Affordability Widget is yet another step by Razorpay towards building a customer-first solution that will attract high-volume sales for businesses effortlessly. Now, online businesses can significantly influence and enable affordability for their customers in more ways than one.”

Balaji Huskur, Head of e-Commerce, Duroflex said, “To us, the Affordability Widget is genuinely helpful in driving revenue and the benefits have far exceeded our expectations. We have seen a phenomenal increase in revenue via Affordable payment options by 170% which has also resulted in an overall increase of 7% in Average Selling Price. What we really like about Razorpay Affordability Widget is that it aggregates all EMI, Pay Later providers, and even highlights No-cost EMIs without any manual intervention. Customers can explore all BNPL options in a single view and this makes decision-making and the purchase experience seamless.”

Razorpay’s Affordability Widget is the recent addition to Razorpay’s Affordability Suite, launched in 2020, a platform that has been helping boost revenue growth for businesses through its industry-leading coverage with 40+ banks and partnerships with fintech firms. The Affordability Suite currently contributes to over 30% of GMV for the e-Commerce giants. With over 11,000+ merchants on the Affordability Suite, brands like Cleartrip, Policy Bazaar, Cultfit, Byjus, Decathlon, Titan, Razorpay believe businesses can achieve up to 40% increase in revenue as a result of early discoverability of affordable payment options (EMIs, PayLater, Offers).

About Razorpay

Razorpay, a full-stack financial services company helps Indian businesses with comprehensive and innovative solutions built over robust technology to address the entire length and breadth of the payment and banking journey for any business. Established in 2014, the company provides technology payment solutions to over 8Mn businesses. Founded by alumni of IIT Roorkee, Shashank Kumar and Harshil Mathur, Razorpay is the second Indian company to be a part of Silicon Valley’s largest tech accelerator, Y Combinator. Marquee investors such as Lone Pine Capital, Alkeon Capital, TCV, GIC, Tiger Global, Sequoia Capital India, Ribbit Capital, Matrix Partners, Salesforce Ventures, Y Combinator and MasterCard have invested a total of $741.5 Mn through Series A to F in funding. A few angel investors have also invested in Razorpay’s mission to simplify payments and banking and redefine how finance works in India.